Social Sciences

The Ethics and Economics of the “Great Recession”

“Do economists need a code of ethics?” It’s not a question often asked about the 2008 financial crisis and great recession that followed—especially when compared to questions about mortgage securitization, monetary policy, and risk. But should it be?

Martha Starr, editor of the new book Consequences of Economic Downturn: Beyond the Usual Economics (Palgrave Macmillan, 2011), says yes, and that we should be asking more questions like it.

The book, a collection of essays by numerous economists, explores the economists-and-ethics question as well as other questions examining the ethical, social, political, cultural, and educational factors behind the crisis and recession.

“We need to consider these other issues if we hope to prevent crises and downturns like this in the future,” said Starr, an associate professor of economics at American University and a former Federal Reserve economist.

Ethics for Economists?

After the crisis hit, numerous people have asked why, despite all the warning signs building up to the crisis, did influential economic policymakers fail to act? Starr says one contributing reason could be that economists have no code of conduct or ethical guidelines ensuring that they use their professional skills in the public interest.

“Unlike almost any other academic profession—statisticians, mathematicians, physicists, sociologists, you name it—economists have always opposed adopting an ethical code outlining how they should act,” Starr said.

The result? Little or no compulsion to spot and thwart developments leading up to the crisis (such as the housing price bubble, rise of subprime lending, and proliferation of collateralized debt obligations) that could (and did) spiral out of control and cause great distress for people ill prepared to withstand prolonged economic and financial distress—particularly the economically disadvantaged and the average working American.

So, why don’t economists have a code of conduct or ethical oath? The author of the book’s essay on this subject, George DeMartino of the University of Denver, says such a code would oversimplify the complex ethical situations that economists face. Instead, he suggests a field of professional economic ethics—similar to the field of medical ethics—to study how economists should address explicit problems that arise in their profession. Starr herself disagrees and thinks economists need clearly spelled out guidelines to help them steer away from ethically problematic situations.

“A well-written code could make people think hard before, for instance, accepting $135,000 in speaker’s fees from an investment bank, then giving that investment bank privileged access to the White House,” said Starr, referring to Goldman Sachs paying that sum in 2008 to then-top White House economic adviser Lawrence Summers.

The Privilege of Power: Shifting Risk While Reaping Rewards

Another essay in the book focuses on why the “too big to fail” organizations took on such outrageously risky investments in the first place. Of course, risky investments present the greatest opportunities for high returns. But the reward is supposed to be tied to the risk. The risks are supposed to pay a premium to make up for the uncertainty in future earnings.

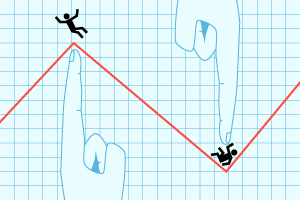

But Starr says in contemporary American capitalism, risk and reward effectively have been divorced—especially for the powerful.

“Numerous laws, practices, policies, and institutions enable the wealthy and powerful to push risks off themselves and onto others—especially the unsuspecting taxpayer,” Starr said.

Take the concept limited liability, which dictates that an investor cannot lose more than he or she invested in a venture. While it was designed to foster new business creation by shielding investors from losing the shirts off their backs if a venture fails, it also creates a screen behind which people can save returns while they are accumulating. If things turn sour, investors get to keep the returns they earned and saved when things were going well.

With the financial crisis, financial executives could keep the outsized earnings they accumulated during the boom years through subprime lending and mortgage backed-securities, but after the bubble burst, the government’s Troubled Asset Relief Program shifted the risks onto Joe and Jane Taxpayer.

“Not only had the average American not agreed to take on these risks and had not benefited from the outsized gains, but they also bore most of the costs of the downturn through lost jobs, homes, home equity, and retirement savings,” Starr said.

The Critically Important Role of the Average American

Other essays in the book explore different issues pertaining to average Americans, such as the pressure we place on ourselves to “keep up with the Joneses” and whether the recession really impacted men more—or just differently— than it did women.

Starr says she hopes the book sheds light on how the crisis and recession affected the average American, whose role in the U.S. economy is critically important.

“Consumer spending accounts for about 70 percent of domestic economic activity,” Starr pointed out. “When average Americans are out of work, have lost their homes and or their savings, they have little if anything to spend and help support the economy.”